Why does your credit score matter? How can you improve it? Where do you even begin?

All of these questions are important to ask if you’re considering buying a home. To qualify, a minimum credit score may be required depending on the overall loan profile. The higher your credit score, the more likely you are to qualify for a mortgage loan and potentially get better terms and lower interest rates, which can result in significant savings over time.

Your credit score may also make a difference when considering the amount for a down payment. The lower the credit score, the greater the risk the lender is taking. To mitigate that risk, the lender may ask for a higher down payment.

To start, think of your credit score as a gauge of the likelihood that you will repay money that you borrow. Many lenders look at your FICO® Score, developed by Fair Isaac Corporation, when you apply for a home mortgage (or any type of loan) to decide whether to extend credit and what the interest rate will be. Lenders may use the median, or middle, score from the credit scores reported from Equifax, TransUnion and Experian.

Improving your credit score can take some time. However, don’t be intimidated by the process. The quicker you acknowledge any issues with your credit score, the sooner you can work on improving it (and the quicker you could be in your new home with a mortgage that works for you).

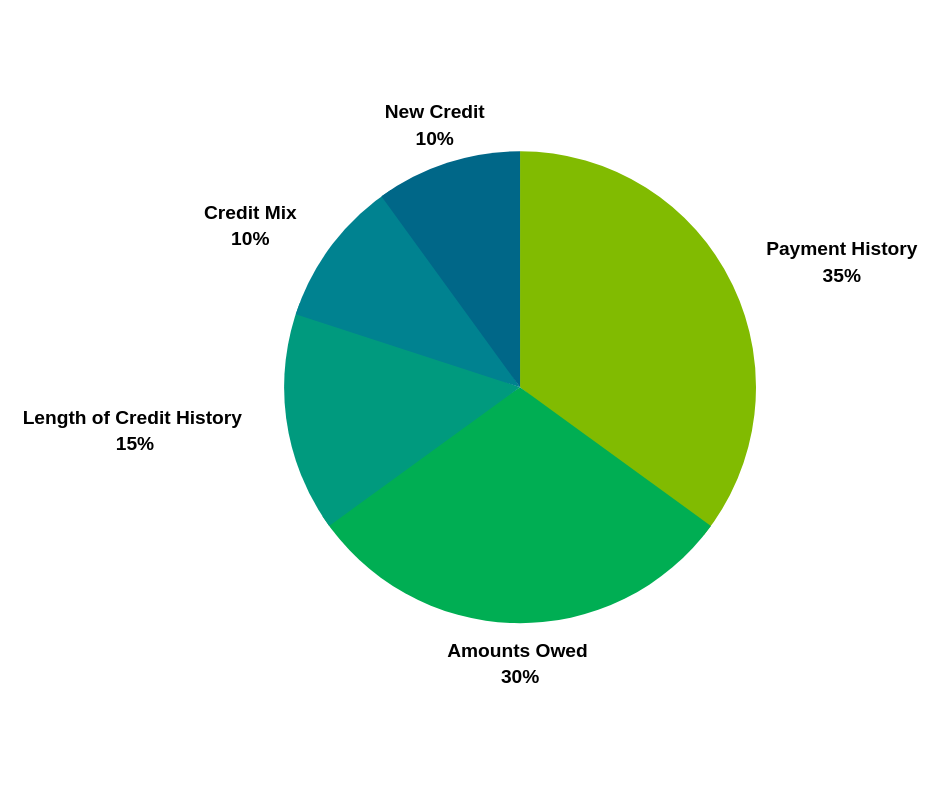

Knowing the various weights given to each component of the commonly used FICO® Score will help you identify any areas that may require improvement. As of Oct. 15, 2019, myFICOTM, a Fair Isaac Corporation website, listed five key factors that go into calculating your FICO® Score.1 Let’s take a look at those factors and some key insights from myFICOTM:

- Payment history: Do you make your payments on time? This is 35% of your FICO® Score and the most important factor. Late payments can negatively impact your score because it demonstrates that you may be likely to miss payments and possibly default on a loan.

- Amounts owed: Your level of debt versus credit utilized is 30% of your FICO® Score. This factor shows how much of your available credit you have borrowed. A higher debt-to-credit ratio can negatively impact your score because it indicates that you may be maxing out your total available credit, which can be a leading indicator of taking on too much debt.

- Length of credit history makes up 15% of your FICO® Score. How long have your credit accounts been open? If your accounts haven’t been open for long, your score will be lower because there isn’t as much history for a lender to look at, which could indicate you may not be as likely to meet all required payments.

- Credit mix makes up 10% of your FICO® Score. This includes installment loans, mortgages, revolving accounts and unsecured debt. Having a variety of credit products may demonstrate you can manage different types of debt and indicate you could be less risky.

- New credit makes up 10% of your FICO® Score. A higher number of recent credit inquiries (or times you’ve applied for new credit) indicates you may be shopping for credit and obtaining new loans that aren’t currently shown on your credit report — and you may be taking on too much debt at once.

Now that you have a better understanding of how a FICO® Score is determined, what the five components mean and how they are weighted, you may be able to improve your overall credit score. Take these tips from our Elevations Mortgage Team into consideration:

- Carefully decide whether you want to close out a revolving credit account, such as a credit card. When you close out a revolving credit account, you reduce your total amount of available credit. This total amount of available credit factors into your FICO® Score, so keeping a credit card open and maintaining a higher available credit balance may positively impact your score.

- Be mindful when shopping for credit. Multiple hard credit inquiries may negatively impact your score. If you plan on applying for a mortgage, you may want to avoid other hard pulls associated with credit shopping before you apply.

- Check freecreditreport.com once a year to make sure all items on your credit report are accurate. If something is inaccurate, file a dispute to ensure the inaccuracy isn’t negatively affecting your score.

- Pay all your bills on time. If you’re traveling, have an emergency or are unexpectedly away from your home, setting up automatic payments may help eliminate late payments that could negatively impact your score. If you have a loan or credit card at Elevations, you can set up recurring payments through digital banking.

- Avoid maxing out your credit card(s). Maxing out a credit card affects your balance of debt to credit and can negatively impact your score.

If you’re looking to better understand your credit score as part of the homebuying process and want to find out more, please contact our mortgage team. We are here to help. You may also try our mortgage affordability calculators or sign up for a complimentary seminar.

Download our free Elevations Home Buyer’s Guide:

1 “What’s in my FICO® Score,” Credit Scores, myFICOTM, accessed Oct. 15, 2019, https://www.myfico.com/credit-education/whats-in-your-credit-score.